Feb 2011 Finance in Focus

Things that could happen

- A major government will go broke in Europe. Ireland came close. Portugal avoided it (so far). But for Spain or Italy, 2011 could be a fatal year. Expect higher bond yields, a falling Euro, and trouble in the streets.

- A U.S. Debt too far. The U.S. government is rapidly nearing its statutory “debt ceiling.” The Tea-Party Congress may compromise with the President to cut taxes and some spending. But the real crisis may come as U.S. cities and States (Illinois, California, and New York) approach bankruptcy and need their own bailout. Will your portfolio be positioned to profit when that day comes?

- China will tighten up. One of the main recipients of the inflation being exported by the Fed is China. It’s desperately trying to contain that inflation (in food, housing, and stock prices) before it leads to social and political instability. But if it “tightens” monetary policy too fast, it could produce a crash – leading to much lower commodity demand. Something to monitor closely.

Things we think you should do to protect yourself

- Continue to trade paper money for precious metals and generally reduce your exposure to financial markets. Those markets are badly distorted by Quantitative Easing and government intervention and they carry a lot more risk than reward right now.

- ONLY buy stocks tied to real asset classes like agriculture, metals, and various forms of energy including uranium. I am NOT bullish on stocks. The ones I do recommend must have an extremely compelling story.

- Keep your ‘contrarian hat’ on at all times! Alarm bells should ring when food and fuel prices begin causing governments to topple… and even though stocks have soared since March 2009 many are now massively overvalued. Always and at all times this year – QUESTION what you’re watching, hearing and reading in the mainstream financial media.

Gold

The key catalyst for Goldman’s suddenly cautious view on gold (which still has a $1,690 price target): the end of QE2 in June 2011. So, presumably, when QE3 is announced in May in order to allow the continued monetization of $4 trillion in debt issuance over the next 2 years, that should be very bullish for gold, yes?

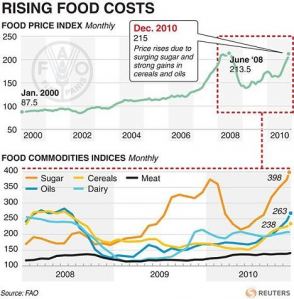

El Nino to La Nina = rising food costs . . .

The changing weather patterns from El Nino to La Nina in the Pacific, however, have been the primary driver for this round as rain patterns change due to a cooling or heating of the mid Pacific.

The world has enough food for its population currently, but after the fires in Russia last summer, the flooding in Australia this winter, and now the on-going drought in China is starting to drain the worlds reserves. If the crops of 2011 are sub-par or worse damaged due to weather related conditions, the planet could be looking at a real famine issue in 2012.

Note: BEIJING – Sunday (31st Jan) was the capital city’s 84th snow-free day this winter, making it the longest winter period without snow in Beijing since records began 60 years ago. And there is no sign of snow falling in Beijing in the next 10 days, which means the city is unlikely to enjoy a “white” Chinese New Year, which falls on Feb 3, according to local meteorologists.