GOLD

The IMF stated that sales will be conducted in the open market, which is interesting because until now, gold has only been made available to central banks. While the IMF remains open to central banks buying some of the gold, sales will be conducted “in a phased manner over time” to avoid disruptions to the open market.

The IMF stated that sales will be conducted in the open market, which is interesting because until now, gold has only been made available to central banks. While the IMF remains open to central banks buying some of the gold, sales will be conducted “in a phased manner over time” to avoid disruptions to the open market.

So, will IMF sales depress the gold price? Well, remember the price rose with the first sale, when it was announced India was buying 200 tonnes of the 212 for sale. But that was an off-take deal, not an open market sale, so the question is legitimate.

One way to look at it is this: global mine production was 80.9 million ounces in 2009, so the IMF’s 6.7 million ounces could be a market-jolting 8.2% addition if dumped all at once. And an 8.2% load would indeed upset a market if we were talking about strawberries or anything else that people buy only for the purpose of consuming.

But most gold isn’t bought for the purpose of using it up. It’s bought for the purpose of holding it. So the relevant comparison for the IMF’s 6.7 million ounces isn’t annual mine production. Instead, we should compare it to the world’s existing stockpile of gold, which is roughly 2 billion ounces. The IMF sale would add just 0.3% to global inventory – hardly a market trasher.

Further, we’ve been down this road before with the IMF. When they sold gold in the 1970s, the price dropped upon the announcement of the sale, but then rose when actual sales took place.

And the dirty joke is this: when the IMF sold gold in the 1970s, it marked a bottom in the price.

The IMF provides some very cushy jobs for the right people, along with a perpetual series of exquisitely catered conferences for the politically connected and politically correct. These people are not exactly known for being the brightest economic decision-makers. However noble their cause, the fact that they’re selling at all in the current environment, given the enormity of the monetary crisis that will only worsen as time goes on, tells me I want to be doing the opposite.

What happens if China buys the IMF’s gold. . .

Debt Watch

The debt-to-GDP ratio for Italy exceeds Greece’s at present, and Japan’s is well above the other countries. Indeed, Japan has the most highly indebted government among OECD countries when measured as a percent of GDP. Note that the U.S. government has a debt-to-GDP ratio that is more or less equivalent to Portugal’s, where yields on government bonds have backed up somewhat this year due to concerns about fiscal sustainability. Is Greece the Tip of the Iceberg?

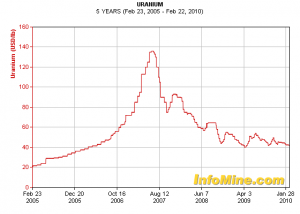

Uranium

Quite simply the demand for uranium is outstripping the primary supply. In fact, starting from now, uranium supply needs to double just to catch up with current demand. And that’s not even taking into account the expected surge in demand as hundreds of new nuclear reactors come on linein the next ten years.

Even in the United States, which has not built a new nuclear plant in thirty years, US President, Barack Obama announced loan guarantees for two new nuclear plants to be built. But since the mid 1990s the nuclear energy industry has been lucky. In a way, nearly half of the demand for uranium has been met thanks to the end of the Cold War.

How so? You may not believe this but almost half of all uranium used in the world’s nuclear reactors has been sourced from… ex Soviet nuclear warheads! Maybe you have heard of it, it’s been referred to as the “megatons to megawatts” program. And it’s been running since 1993, but it ends in 2013.

Key Fact: There are currently 436 nuclear reactors in operation worldwide.

Right now there are over 50 reactors under construction in 13 countries along with 142 nuclear power reactors planned and an additional 250 which are being proposed. (source: World Nuclear Association)

According to Steve Kidd at the World Nuclear Association, another 142 are in the pipeline, and 53 of these are already under construction. Of the latter, 20 are in China. “We forget that in France in the 1970s they were building five new reactors a year,” he said. “The Chinese are just doing what the French did, but on a Chinese scale.”

The mining boom has been boosted by a surge in the uranium price. “For three decades uranium cost $10 a pound because nuclear power wasn’t seen as very desirable. Now that we have all these concerns about the environment and going low-carbon, it’s different. It hit $137 [a pound] two years ago,” said Joe Kelly, head of nuclear fuel markets at ICAP Energy. Today the spot price for un-enriched uranium is $42 a pound, enough for most projects to go ahead.

Contact us at Banner for selected shares in this sector.

Stories of Interest:

WASHINGTON (Reuters) – U.S. states face a total shortfall of at least $1 trillion in their funds for employees’ pensions and retirement benefits, and their financial problems are quickly mounting, according to a report released by the Pew Center on the States on Thursday http://www.reuters.com/article/idUSTRE61H13X20100218

http://www.news.com.au/business/secret-summit-of-top-bankers/story-e6frfm1i-1225827289543

http://news.bbc.co.uk/2/hi/business/4684108.stm

Don’t get left behind start your own personal portable pension today

I would like to…

Find out about offshore products and wrappers

Know more about offshore life assurance companies and Pensions

Start to Save for my retirement or for the future

Complete a client profile for a personal investment report

Register for the Finance in Focus newsletter