Puts things into a bit of perspective. . . now about gold, do you have any?

Puts things into a bit of perspective. . . now about gold, do you have any?

Here are the elements of difficulty for Japan, each one serving to reduce their economic and financial stability:

The total shutdown of all 54 nuclear plants, leading to an energy insufficiency

Japan’s trade deficit in negative territory for the first time in decades, driven largely by energy imports

A budget deficitthat is now 56% larger than revenues (!!)

Total debt standing at a whopping 235% of GDP

A recession shrinking Japan’s economy at an annual rate of 2.3%

This will lead to renewed efforts to debase the yen and we will see 100 vs the $ again. Perhaps an overshoot like in 1998, 79 then back to 147 . . .

America’s constantly increasing national debt is expected to cost more than $5 trillion in interest payments alone over the next decade, according to projections from the CBO. Interest rates on U.S. bonds are near record lows, but the CBO estimates they could rise to 5 percent by the end of the decade. However, if interest rates rise just one percentage point above the 5 percent estimate, it could add around $1 trillion to interest costs.

Ineptocracy

(in-ep-toc’-ra-cy) – A system of government where the least capable to

lead are elected by the least capable of producing, and where the

members of society least likely to sustain themselves or succeed, are

rewarded with goods and services paid for by the confiscated wealth of a

diminishing number of producers.

Low rates continue to 2014. Last year, the Federal Reserve predicted that the US economy would recover into 2012, and expectations were that the central bank would begin tightening interest rates by as early as 2013. This week we learned that the Fed expects to hold rates “exceptionally low” until late 2014. Although the Fed expects inflation to remain low, gold had a big rally believing instead that inflation will increase. Do you remember the rule of 72? When people still put money in the banks – to estimate how long it takes for your money to double, simply divide 72 by the interest rate. So at 6% – 12 years and 5-6% was on the low side for a long time. It was helpful to know in those days that one did not have to learn about risky investments and could still grow their savings. Here is the Fed fund rates since 1952.

These are the rates that the Fed (a private corporation) charges banks and unfortunately they do not pass along these great rates to us and at the same time banks no longer pay us any worthwhile interest to hold our funds. If your bank gives you 2% interest on your savings you can double your money in 36 years and at 1% in 72 years. Though by then that money will not be worth much as long as the Fed exists and prints the value of money away. graphs – RTTNews

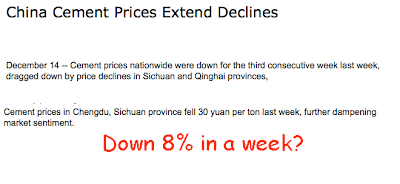

A question for readers: How big is China when it comes to cement? Keep in mind

that the EU and the USA have GDPs of about $15T apiece. China is much smaller

and has a GDP closer to $6T. Knowing that, what’s your guess on how China

stacks up in the world of cement? I would have thought that China was as big as

the US or EU. The economy is smaller, but they are building so much, my guess

was about equal.

Wrong.

wrong. wrong. I must admit, I was blown away by this:

China is 25 Xs larger than either the US or EU! When it comes

to cement, forget the rest of the world and focus on what is happening in the

country with a 54% market share.

China’s

cement production has been on a tear for years. But it’s slowing down. The

production for 2011 will come in at 1.88mm metric tones, an increase of only 6%

over 2010 (the slowest in 15 years). The Cement Association of China is

forecasting that 2012 total production will be “about the same as 2011”. We

shall see. I saw this article on cement pricing in Sichuan province.

Since 2004 China’ GDP has doubled. So has its cement production. That’s not a

coincidence. The forecast for unchanged production in 2012 is inconsistent with

high growth in GDP. What does zero growth in cement production translate into

Chinese economic growth? My guess is that 4% GDP would be a good result. That

would be well below stall speed for China.

A Very Subtle Form Of Theft

Say what you want about him, but Bernie Madoff was a guy who knew how to keep the party going. For years, he ran one of the largest private-sector Ponzi schemes in history and always heeded the golden rule of financial scams: make sure your inflows are greater than your outflows.

He was finally done in when redemptions exceeded new investments. He didn’t have enough cash to pay out investors, and he wasn’t able to scam more people into paying in to the scheme. As a result, Madoff finally had to admit that the whole thing was a total fraud.

Governments around the world are in similar situations right now with their own public sector Ponzi schemes. Faced with failed auctions, declining demand, and rising yields, politicians are having to resort to desperate measures.

Like any good scam artist, they’re appealing to the masses first; all over Europe, governments are sponsoring new marketing campaigns suggesting that it’s people’s patriotic duty to buy government debt.

In Spain, they’re actually issuing instruments called ‘Bonos Patrioticos,’ or ‘patriotic bonds’. Ad campaigns say that the bonds are “good for you, good for the future.”

In Ireland, they’ve issued “Prize Bonds” which carry a 0% interest rate; instead of receiving interest, bondholders are entered into a weekly lottery contest. Naturally, lottery winnings are only possible as long as people keep buying the bonds… pretty much the definition of a Ponzi scheme!

In Italy, they’re rolling out the country’s sports celebrities to encourage everyone to buy Italian sovereign debt.

What’s ironic is that Italy’s dismal balance sheet is almost universally acknowledged. It’s as if everyone knows the country has almost no chance of making good on its obligations, but they still feel the need to willingly throw away their hard earned savings for the greater good of political incompetence.

Thing is, it’s not the millionaire sports stars, wealthy business leaders, or political elite who are buying these bonds… at least, not in anything beyond a token, symbolic amount. It’s the average guy on the street who really stands to get hurt when the government finally capitulates.

This is a truly despicable act and amounts to theft, plain and simple.

The United Kingdom, which is rapidly reaching this banana republic sovereign debt status itself, has unveiled a plan to issue roughly $50 billion in infrastructure bonds. This would be the equivalent of issuing $300 billion in the US– not exactly chump change.

Given Britain’s already colossal debt level, private investors aren’t exact diving in head first to loan the government even more money.

Undeterred, British Chancellor George Osborne plans to ‘highly encourage’ UK pension funds to mop up about 60% of the total amount. “We have got to make sure that British savings in things like pension funds are employed here and British taxpayers’ money is well used,” he said.

In other words, ‘we are going to make sure that British people buy our junk, one way or another.’

The last year has seen numerous pension funds around the world, from the United States to Argentina to Hungary, be raided for the sake of keeping these Ponzi scheme going. The UK is already lining up to be the next.

It’s one of the last acts of a truly desperate government to begin directing public and private savings into their Ponzi schemes.

Fast-forward a few downgrades and you can plan on seeing the exact same thing in the United States– appealing to people’s patriotism to loan their hard-earned savings (if they even have any) to the Federal government at a rate of interest that fails to keep up with inflation.

It’s nothing more than a very clever (and subtle) form of theft.

From Simon Black of Sovereign Man

Since April 2010, the Pew Fiscal Analysis Initiative has published several reports explaining the medium-and long-term fiscal challenges facing the federal government. With stagnating economic conditions and the passage of new legislation, especially the Budget Control Act of 2011, the outlook for the deficit and debt has changed considerably over the past six months.

Click here to see the rest; PEW