To say we’ve had a few difficult years is putting it lightly. Lehman shock, sub prime mortgages, toxic derivatives, bad banks, sovereign debt crises, near zero interest rates, rising energy prices, Arab spring, Occupy Wall Street are just some of the most prominent news pieces we’ve had to digest in recent years. And for us in Japan the apocalyptic and heart-breaking disaster that occurred a year ago, the persistently strong Yen, a debt to GDP ratio of almost 250% and no economic recovery boost in sight has led to even greater anxiety about the future.

In view of world events spinning faster and faster and because life is getting ever more complicated, we have to make sure we are brave and focus much more diligently on our personal finances in general and retirement planning in particular.

I believe all surveys ever published on retirement planning have come to the conclusion that the majority of people just don’t save enough and don’t start early enough with the focus on saving rather than spending. It is of course difficult not to spend and people go through tough times like sudden unemployment, divorce, illness, etc. Then there is the cost of children’s education, the need for a new house, a new car, and so on.

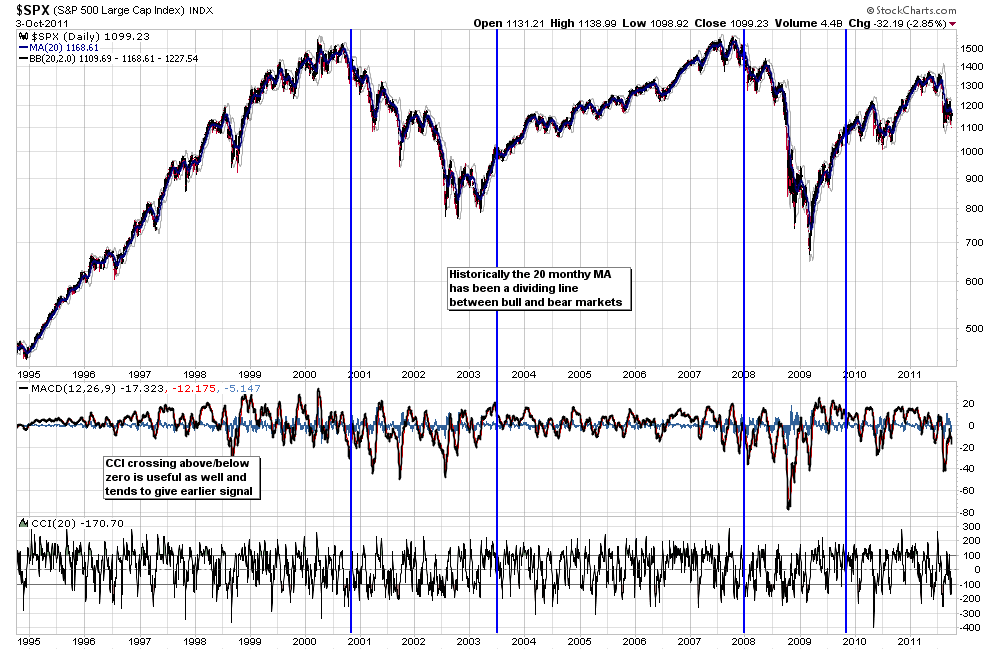

Putting off retirement planning until later, whenever that may be, having best laid plans derailed by sudden tough times, living beyond one’s means, not having a healthy savings habit, etc. are major reasons for experiencing a shortfall in your savings in later years. Another reason that cannot be denied is the fact that annualised growth rates have come down over the last 15 years and the usually projected rates of 7~9% have been more around 3~5%. Some investments haven’t delivered their expected returns and interest bearing products pay next to nothing. People have been put off by extreme market events and volatility and have also learned that real estate investments are prone to cycles and crashes; a stand-alone property investment is not a suitable retirement strategy.

So what to do? Go back to the basics and be undeterred: Consider your time horizon until you will likely have to draw from your savings, save as much as you can on a regular basis, pay attention to and discuss diversification and allocation between conservative and aggressive assets to ensure you have enough overall growth. People in their 50’s, for example, can’t take the downside of the stock market but need the upside of equity or equity-like returns. That is where careful asset allocation comes into play, and a strategy of regular investing combined with ad hoc lump sum investments usually works well if allocations are changed as time and market cycles progress.

Having a realistic outlook on retirement life is also helpful: Maintenance of standard of living vs. something you always wanted to do but haven’t had time for during your working years – the latter should be budgeted for separately. Consider changes in housing needs, i.e. downsizing to cut cost. A new study has shown that single retirees are having a tougher time in retirement compared to married couples; e.g. single baby boomer men compared to their married counterparts have a 19~34% higher savings deficit for retirement.

To sum up: Be undeterred, build up your savings as consistently as possible (aim for a higher retirement income, let’s say 75~80% of your pre-retirement income to keep the shortfall to a minimum and to factor in inflation), keep an eye on diversification to maximize growth and review your progress regularly (at least once a year!), and be realistic in regards to your retirement years.

Last but not least, don’t hesitate to contact me to have a chat about your personal strategy and how I could possibly help. Feel free to email me your comments and feedback. Now is not the time to do nothing but high time to review what you have been doing so far.

by Stefanie Richert, Senior Adviser