QE or not to QE?

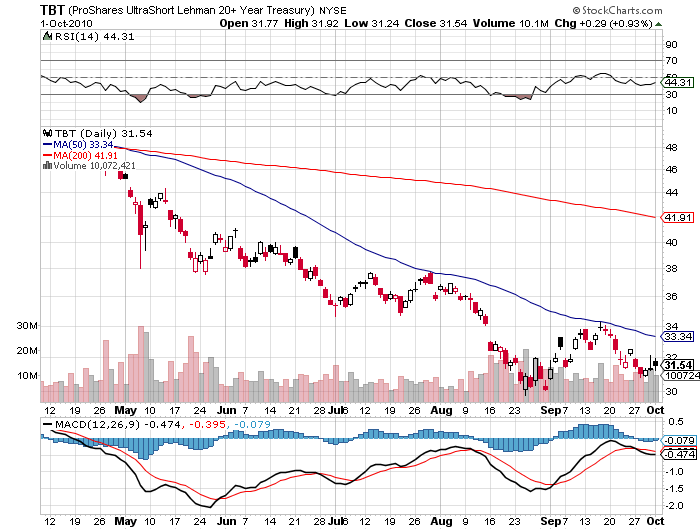

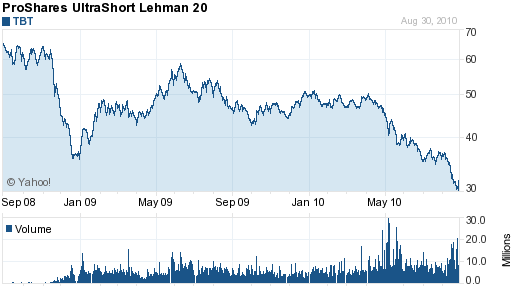

It seems that QE2 will get a serious review during the Federal Reserve’s April meeting, and could be cut short by two months in order to send financial markets the message that they will not allow inflation to get out of control. This assumption is taken from Federal Reserve Bank of St. Louis President James Bullard, when speaking to reporters in France on March 26, said “If the economy is as strong as I think it is, then I think it may be reasonable to send a signal to markets that we’re going to start withdrawing our stimulus, and I’d start by pulling up a little bit short on the QE2 program… We can’t be as accommodative as we are today for too long, we’ll create a lot of inflation if we do that.”

So what could happen?

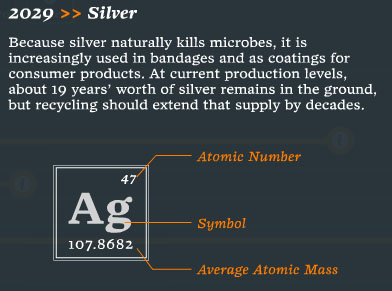

- Some still believe that QE3 is a distinct possibility, and they have invested accordingly. These investors would be in for a rude awakening if QE2 was cut short – think in terms of Silver investors who bought at the top of the market thinking silver was destined for $50 an ounce.

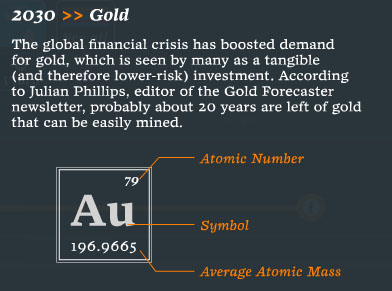

- Others believe that QE2 will continue through to its scheduled June conclusion without any hiccups along the way. This is the more moderate camp who have parked capital in Gold, Silver and Oil, who didn`t buy at the top of the market, but had planned to reduce positions once QE2 ended in June.

- And there are those that believe QE3 was a non starter, and QE2 would probably finish according to schedule, but wanted to front-run the selling by positioning themselves for the inevitable asset realignment by being in position in late April (after April options expiration for example).

So what should you be watching out for in April?

- If more hints from Fed officials regarding ending QE2 early start surfacing in the media, coupled with stronger jobs numbers, then take them as a collective indication that the time has come to cash in on some of the profits from commodity related investments.

- An early end of QE2 would strengthen the U.S. Dollar on a short term temporary basis, and could bring headwinds to commodity-based currencies such as the Aussie and Canadian dollars.

- GOLD – if we start to see gold fall under 1400 we may see a reversal to the base around 1320 – 1340 region (which could again be a buying zone) the Gold bull story is far from ending.

Has Reality Changed?

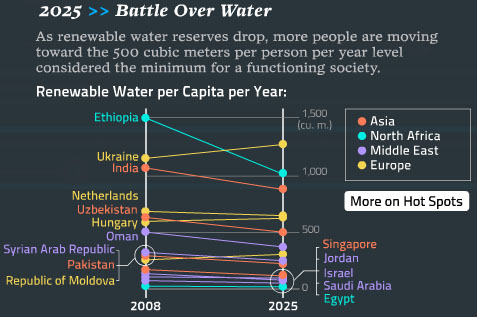

- The change in the Middle East is from some form of government to Chaos. Change in the Middle East is NOT positive for the West, it is a huge unknown.

- The mountain of OTC derivative paper is not going away.

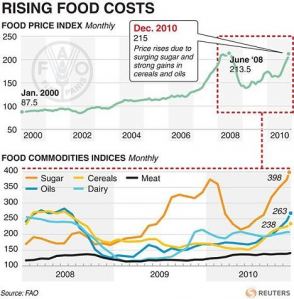

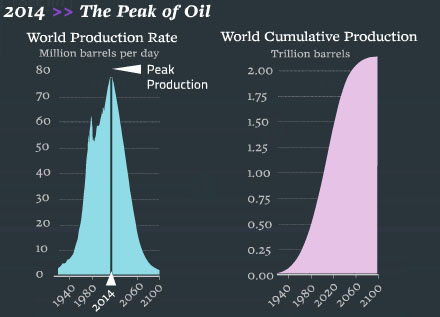

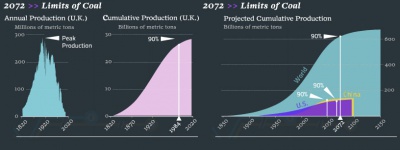

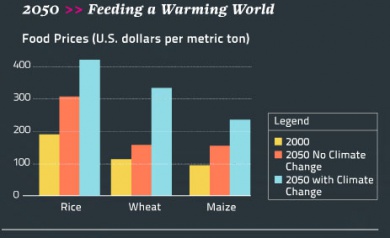

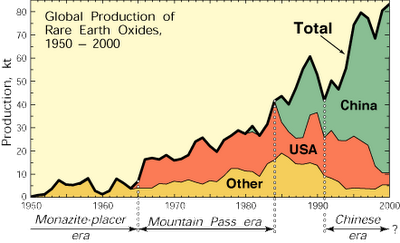

- Peak Production of Energy is behind us. Peak Oil means Peak oil is upon us. Energy will become scarcer in the future and thus more expensive.

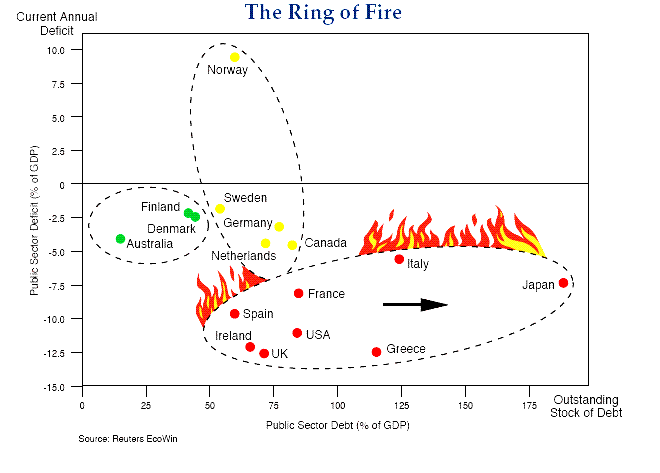

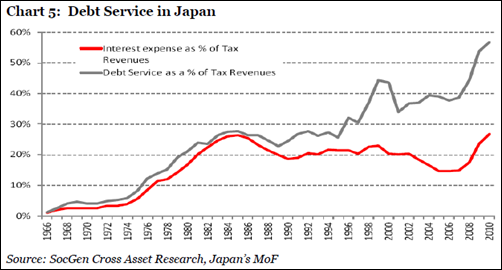

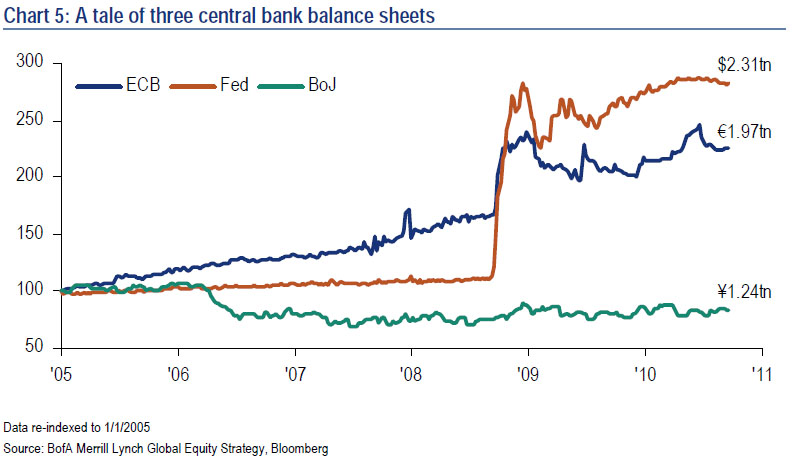

- The Debt in Japan, Europe and the USA is NOT going away but it is getting bigger! Consider US government revenues of $2.228 trillion (CBO FY 2011 forecast). If rates go up (and they will) 1/3 of America’s current tax take would be spent on INTEREST ONLY! Take Japan and it could be closer to 70% just to cover the INTEREST ON DEBT! In Europe we will have act two from Ireland and Greece with likley defaults, then there is Spain and Portugal.

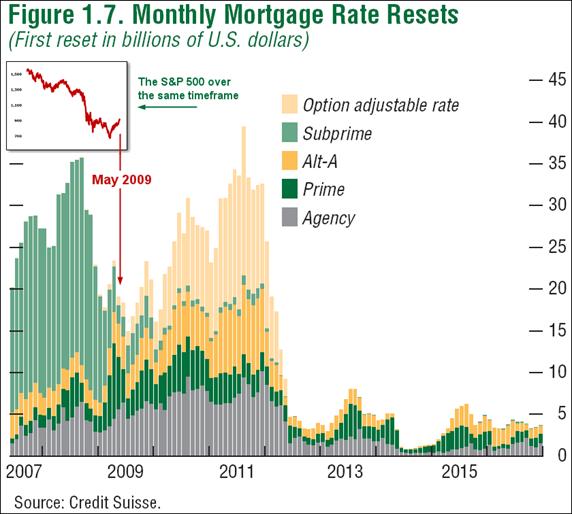

US Housing

Recent reports on home sales and new home construction continue to come in below even the most conservative expectations, which has again led to talk of a double dip for housing. We have consistently downplayed the talk of a double dip because we believe it provides an oversimplified view of the housing market. There is no doubt that housing prices are falling again. Prices had previously been supported by an enormous amount of fiscal stimulus, including tax credits for first-time buyers and trade buyers, tax-loss carry backs for homebuilders, massive purchases of mortgage-backed securities by the Federal Reserve and a whole host of foreclosure mitigation programs by the mortgage providers Fannie Mae and Freddie Mac and the U.S. Treasury. Now that many of these programs have ended or are winding down, home prices are again reflecting the weakened underlying fundamentals, which are dragging prices lower.

Focus on Wind and Solar

Whenever renewable energy is mentioned, wind and solar usually get the attention. Yet, wind and solar, along with biomass and geothermal, fall within the “Other Renewables” category that makes up just 3.6% of U.S. power (See Chart Below). Most countries are similar . . .

So should one add nuclear positions to the Portfolio? Yes in our opinion. When is the best time to buy? When everyone else is selling! That has happened with U308 stocks some fell 50% — huge buying opportunity is at hand.

YEN?

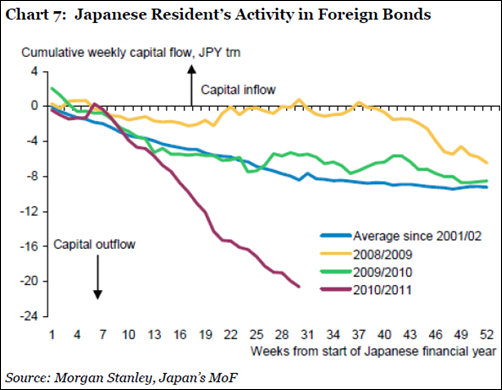

Well it surged to a record high against the dollar, hitting an all-time peak of Y76.25 on March 16. The reason why: speculation that Japanese institutions would repatriate funds to deal with the aftermath of the crisis. The G7 stepped in (first time in over 10 years) to stabilize the Yen and a line in the sand seems to have been drawn at just over 80 yen to the US$ . . . with the massive amount of funds the bank of Japan has put into the market and the massive amount of DEBT the Japanese government will take on to rebuild this should be the turning point or perhaps tipping point for YEN strength. Now is the time to sell Yen and seek reward elsewhere.

GOLD.

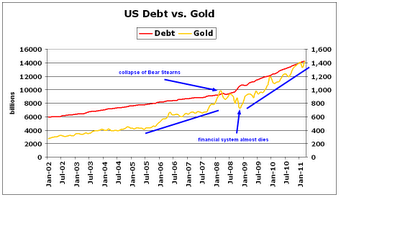

Notice the correlation of gold going up as Debt goes up . . .

While Gold is cheap relative to its inflation adjusted all time high (US$2300), Gold mining stocks are absurdly cheap. How cheap? The Gold Miners ETF (GDX) reserves roughly $430 an ounce.

Fact: The 25 companies that comprise GDX have roughly 700 million ounces in reserves. And currently the combined market cap of all 25 companies is about $300 billion.

So the market is literally pricing this Gold at $428 per ounce, round up to $430.

GDXJ – the junior gold miners is similar —

note above: GOLD – if we start to see gold fall under 1400 we may see a reversal to the base around 1320 – 1340 region (which could again be a buying zone) the Gold bull story is far from ending.

Worried about your pension? Unsure about your investments? Your Banner adviser can help you make sense of your finances.

More than that, they will make sure they understand your financial priorities and, drawing on their extensive experience and expertise, work with you to help you achieve them. So whatever your objectives – fund your children’s weddings, retire early, pass on your wealth to your family, enjoy the holiday of a lifetime, increase your retirement income – they will do their utmost to find solutions that work for you.

Life is not always plain sailing: your financial situation may change, as may your priorities. Yet clients know that they can trust their Banner adviser to steer them through the financial consequences of whatever life brings.

Importantly, all our advisers are independent and therefore their advice is truly impartial.

info@bannerjapan.com or call 03 5724 5100