With Complacency Comes Danger

It is a measure of the powerful positive sentiment currently driving the market that each successive concern is readily dismissed. Dubai World debt problems? They are rich, they can cover it. Greek debt? It is a small country, someone will bail them out. Breakdown of the Euro zone? It will probably be better to lose a few countries anyway. China property bubble? The authorities can contain it. And Goldman Sachs malfeasance? Well, that is probably the least surprising and least concerning of the lot, assuming you do not own GS stock!

But all these issues have one thing in common. They are the result of excessive debt and leverage. Debt is useful and productive up until a point. As long as the underlying asset generates enough cash flow to service and gradually pay down the debt, all is well. But when the underlying asset suffers a decline in cash flow, the party is over. Debt servicing becomes harder and default eventually occurs.

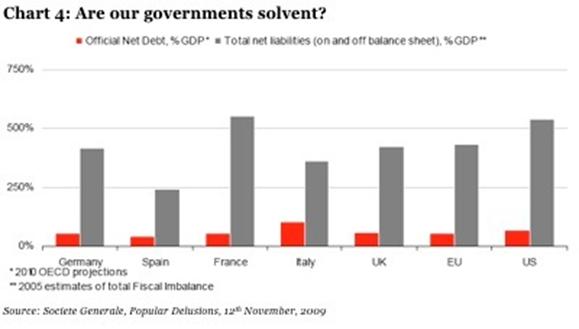

Governments around the world realize this and they have (so far) offset the effect of contracting private credit by running huge budget deficits. Ironically enough, equity markets are the main beneficiary of the increase in government debt so it is no surprise that investors are showing no signs of concern. The International Monetary Fund (IMF) is not so sanguine though. In it’s just released Global Financial Stability Report the IMF asks, could Sovereign Risks Extend the Global Credit Crisis’.

“The crisis has increased sovereign risks and exposed underlying vulnerabilities. The higher budget deficits resulting from the crisis have pushed up sovereign indebtedness, while lower potential growth has worsened debt dynamics. For example, G-7 sovereign debt levels as a proportion of GDP are nearing 60-year highs. Higher debt levels have the potential for spillovers across financial systems, and to impact on financial stability.”

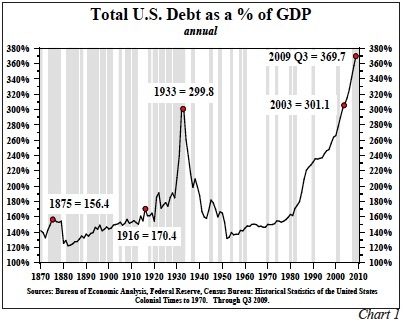

The chart below shows G7 sovereign debt levels as a proportion of GDP. Note the spike higher from 2007/08. Now, many will look at this chart and say so what, we have been here before. While that is certainly the case, there is one crucial difference. In the 1950s and 1960s debt levels were falling from the excessive levels built up during the aftermath of the depression and the Second World War. On the plus side, private debt levels were tiny and as nations recovered from the Depression and war, increased credit flowed to the private sector.

More to the point, most of the increased credit was used for productive purposes. Banks hadn’t invented mortgage equity withdrawals or subprime loans yet, so loans tended to be for production rather than consumption. It is not surprising therefore that the US golden period was during the 50s and 60s.

But the global economy is now in a position of high government AND high private sector indebtedness. Because governments are quite good at spending other people’s money, we expect the sovereign debt ratio to go much higher in the years ahead as an offset to contracting private sector credit. But like other concerns before it, equity markets around the world just don’t seem all that worried by 50 year high government debt levels. Nor does the bond market for that matter. In our experience, investors don’t care about such trivial things as housing bubbles, sovereign debt defaults, or currency breakdowns until they have to. Source: Sound Money. Sound Investments.com

We strongly believe caution is warranted.

Are we in Deflation or Inflation?

The Bond Markets tell us Inflation is dead there are numerous articles telling us so, even Ben Bernanke! It must be true!

So what should you do – conventional wisdom says this:

Investment Themes For Deflation

- In deflation, debt is the enemy.

- Risk is to be avoided.

- Cash is raised.

- Treasuries are sought out as a safe haven

- CD ladders offer a good investment structure.

- Gold, acting as money does well.

- Select equity shorts or Puts are a standout.

- Renting as opposed to owning a house should be considered.

- Currency plays.

Investment Themes For inflation

In inflation the last place one wants to be is in cash.

- Commodities in general are a standout.

- Gold is a standout.

- Precious metals are a standout.

- Property is a winner.

- Equities are a winner.

- Treasuries are distinct losers if not outright shorts.

- Foreign currencies

- Energy a winner

Looking at the above two scenarios we have bits of each doing well.

Deflation in economics is a persistent decrease in the general price level of goods and services, when inflation is below zero percent, resulting in an increase in the real value of money – a negative inflation rate. When the inflation rate slows down (decreases, but remains positive), this is known as disinflation.

Inflation destroys real value in money. Deflation creates real value in money. Alternatively, the term deflation was used by the classical economists to refer to a decrease in the money supply and credit; some economists, including many Austrian school economists, still use the word in this sense. The two meanings are closely related, since a decrease in the money supply is likely to cause a decrease in the price level.

Deflation is considered a problem in a modern economy because of the potential of a deflationary spiral and its association with the Great Depression, although not all episodes of deflation correspond to periods of poor economic growth historically.

Disinflation is a decrease in the rate of inflation. This phase of the business cycle, in which retailers can no longer pass on higher prices to their customers, often occurs during a recession. In contrast, deflation occurs when prices are actually dropping.

To fully understand disinflation we need to first understand inflation. The word inflation originally meant an increase in the supply of money which resulted in an increase in prices. But, in more recent years, the word inflation has come to mean the result rather than the cause. i.e. an increase in prices rather than an increase in the supply of money. This might be partially the result of the wide spread usage of the term “inflation rate” which measures the rate of price increases rather than the increase in the money supply.

Disinflation on the other hand is a more recent term and so only has the connotation of moderating prices i.e. prices that are not increasing as quickly as they once did. For example if the annual inflation rate one month is 5% and it is 4% the following month, prices disinflated by 1% but are still increasing at a 4% annual rate.

If available money to spend indeed contracted, then the deflationists are right about seeing deflation in 2008. But if the money supply fell by less than stocks and commodities plunged, was flat, or even grew, then deflationists are wrong. When prices fall simply because demand declines (too much fear to buy anything immediately), this is merely supply and demand. If money didn’t drive it, then it isn’t deflation.

Since the commodities slide started in July 2008, annual MZM growth on a weekly basis has averaged 11.6%. It never shrunk! If the broad US money supply always grew by at least 9% over the period of these sharply lower prices the deflationists cite, and averaged 12% to 13%, then how on earth could the stock slide or commodities slide be deflationary? Prices didn’t fall because there was less money available to spend on stocks and commodities, but because demand plunged relative to supply.

Deflation is exclusively monetary in nature. And since mid-2007 when the general credit crunch started unfolding, the Fed has grown broad money by the fastest annual rates seen since the aftermath of the 9/11 terrorist attacks. This fact is indisputable. Without a shrinking money supply, negative growth rates, there is no basis for declaring deflation. Redefining “deflation” to mean something it is not doesn’t make it so.

AS a result we think INFLATION is coming . . .

Inflation is Dead – what utter hooey.

The Alternate CPI puts the annualized inflation rate at 9.47%. (Data from www.shadowstats.com).

For a fascinating perspective on inflation and the adjustments to the official calculation method, watch this from Chris Martenson.

Now when you consider the inflation figures Washington puts out each month, the March’s Consumer Price Index (CPI) data; the “core” inflation rate rose a modest 0.1%. So every politician and most of Wall Street analysts point to it and proclaim that inflation is dead.

Inflation? “Not a problem” … “tame” … “easy to deal with” — those were some of the comments and headlines that came out after the figure was released.

I disagree just have a look at what is happening around you – what is cheaper than last year?

Here are just a few examples … of everyday things that are going up

- The price of oil is up over 50% from a year ago. In April 2009 it was $50 a barrel now it is $84!

- A gallon of unleaded gas is up 15% since April last year!

- Cotton is up 30%

- Copper prices are up 57%

Now, you tell me, is that 0.1% inflation? I don’t think so! The average price appreciation of the above, which are pretty much staple items, is over 10%.

That’s even a bit higher than the action we’ve seen in the Commodity Research Bureau’s Index (CRB Index) of 19 widely-traded natural resources and commodities. According to the index, prices of raw materials are up nearly 8.5% since the beginning of February.

And don’t get me started on College tuitions as are projected to increase into the double-digits in many cases for the 2010-2011 school year.

Government around the world are massaging figures – protect yourself and start your own Personal Savings Plan today as now is the time for DIY.