You are in a bull market until proven otherwise. We are in a bull market and the question is when is the change coming?

This USA bull run started way back in 2009.

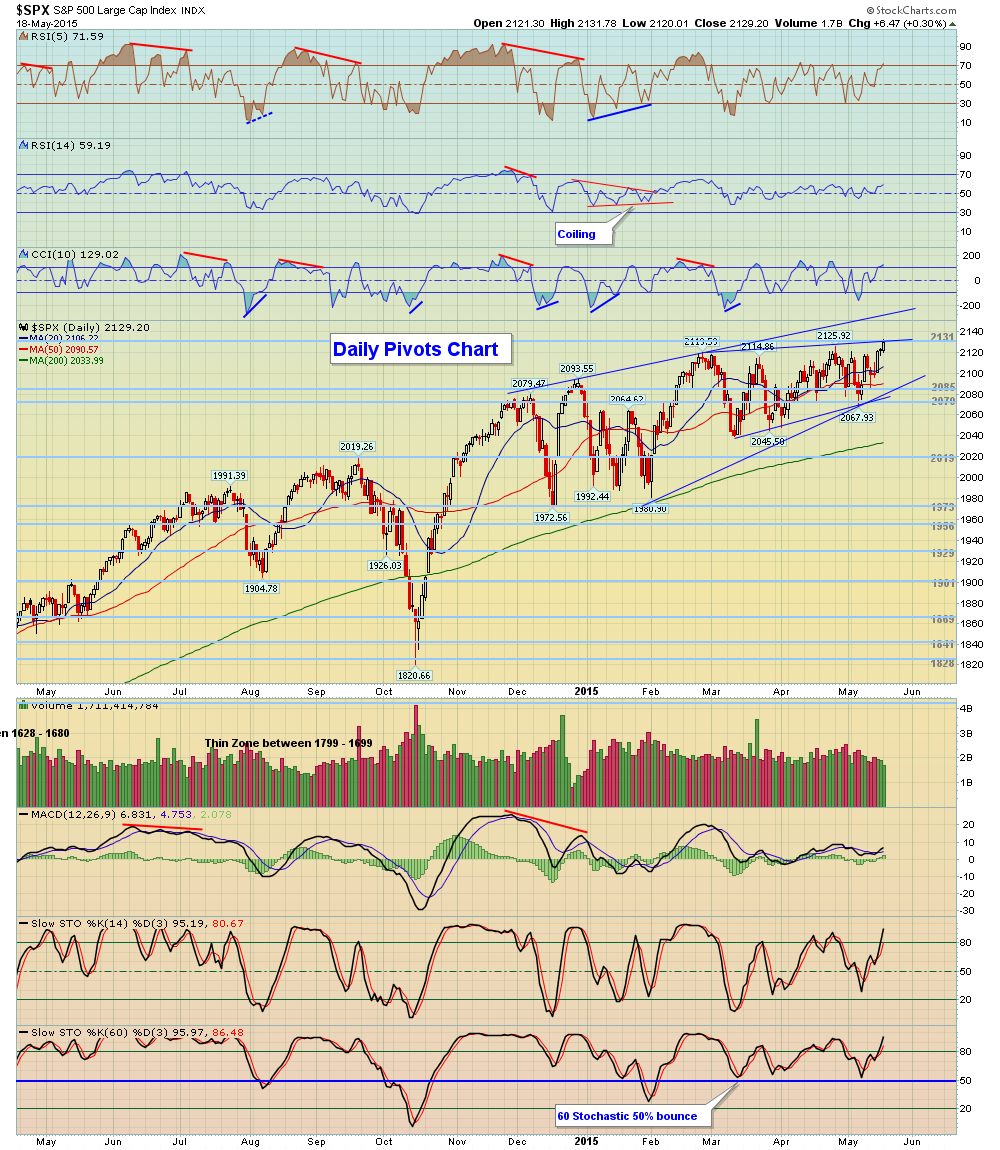

However, on a more current look the last attempt to decline was in Oct. 2014 when the S&P lost about 200 points over about 3 weeks. Then a slight wobble of 100 points in Dec and it has been a slow choppy rise to where we are today at all-time highs. Will we go higher? As you can see in the graph below the S&P is in a rising wedge which over time will resolve itself one way other the other. There is a stronger probability that it will test the October 2014 lows (at worst) and then head back up, we will review if that comes. So, we would wait until this unfolds before entering or adding more to equities.

Japan….the economy is in an untenable position. Unless Japan open their borders and embrace change, both unlikely, their hopes to end 25 years of economic malaise rest with Abe-no-mics and massive money printing. Abe’s three policy arrows have been largely rhetoric and designed to keep the status quo… strange as Abe did campaign on change and the future. But, bearing in mind 40% of the voters are over the age of 60 why would they want any change quickly? Abe clearly has this in mind and not the future of Japan. Difficult and costly choices need to be made by the Japanese people as the leaders will not do it.

As you can see in the chart above the Nikkei has taken 25 years to reach the top of its Bollinger band. (This is one of the more popular technical analysis techniques. The closer the prices move to the upper band, the more overbought the market, and the closer the prices move to the lower band, the more oversold the market.)

The real problem in Japan is the containment of the human spirt – Japan needs to unleash this innovation once again — an example is as Richard Katz says “brands like Sony, Panasonic and Sharp continue to dominate in Japan – where not a single new market entrant of any significance has emerged since 1946. In the US by comparison, 8 of the top 21 consumer electronics hardware firms, including Cisco, did not even exist in 1970. In Japan, incumbents keep holding on.” We believe the bureaucracy of Japan has a huge role in stifling this wonderful country.

A current example of the human spirt alive and well in Japan is the food and restaurant scene now available. Back in 1990 the only foreign food was a limited McDonald’s menu – today Tokyo has more Michelin stars than France. Good thing food bureaucracy is relatively low.

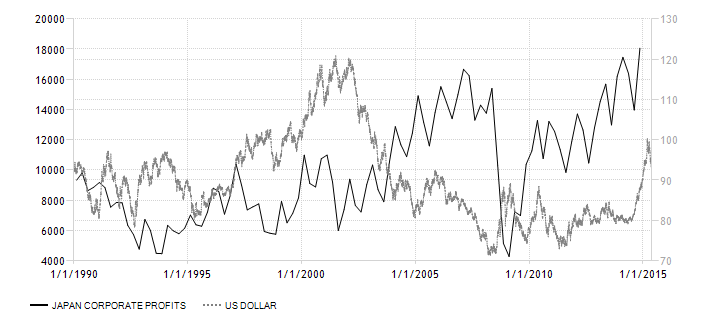

The Japanese market continues to rise but the gains now are very correlated with the direction of the Yen and that “easy rise” in the stock market has happened. Going forward can companies in Japan make real profits that are not directly linked to the weakening Yen?

As a contrast; Australia

Source http://www.tradingeconomics.com/japan/corporate-profits

So what other markets are lined up for a correction? Seems all are at or not far from mulit-year highs and my guess is the US market will lead, as whatever it does the rest of the worlds markets will follow — some more violently than others.